The Story of a Million Miles

Just another home buyer with a credit card and the story of a million plus miles.

After years of renting, I finally pulled the trigger on something I’ve been contemplating for a while: buying my first home.

The motivation wasn’t necessarily a financial decision. In fact, if we go purely by Excel sheets and ROI formulas, renting might be the smarter financial decision. But life isn’t always about optimised spreadsheets. For me, this was about having a permanent space I could shape on my terms, one that was truly mine.

Now, if you know me, you know I rarely leave rewards on the table, particularly when they are big-ticket transactions. So, when it came time to make this purchase, I asked myself: “How can I maximise this massive expense for the best possible return in credit card rewards and points?”

This blog post isn’t a debate on whether you should rent or buy. It’s a deep dive into how I used credit cards smartly during the home buying process, including:

The cards I used,

The logic behind each choice,

The stages of payment I optimised,

And what it earned me in return, miles, points and vouchers.

For obvious privacy reasons, I won’t be sharing exact transaction figures, but to help contextualise, let’s assume a property value of around ₹1 crore (excluding taxes, stamp duty, registration, etc.).

A few important disclaimers if you’re thinking of replicating this approach:

Liquidity is key. If you can’t pay off your cards in full, the interest will wipe out every point you earned, and more.

Credit limits matter. A large transaction can spike your credit utilisation and affect your credit score if you’re not careful. Make sure you have a sufficiently large credit limit on your CIBIL.

Stick to your budget. Just because you’re earning rewards doesn’t mean you should make unnecessary or oversized down payments. Remember, home loans are one of the cheapest forms of borrowing.

Now, yes, using a credit card to buy a house isn’t exactly normal. But if you know how to play the game, it can be incredibly rewarding. For me, there were three key reasons why it made perfect sense:

1. Milestone Spending Made Easy

Many premium credit cards in India offer lucrative bonuses or unlocks when you hit certain annual or monthly spending milestones. These rewards can range from flight vouchers and hotel stays to bonus points and fee waivers. A large one-time expense like a home purchase is the easiest way to hit those thresholds without any artificial spending.

2. A Windfall of Points & Miles

At the core of it, this was about rewards. Swiping the right card, at the right merchant, under the right MCC, meant I could walk away with a serious stash of transferable points and air miles. In the points game, volume matters.

3. Short-Term Liquidity Management

Let’s not ignore the practical angle, credit cards offer you a 30–45 day interest-free repayment window. That kind of breathing room can be a big advantage when you’re juggling multiple payments: builder dues, registration, interiors, insurance, and more. If you have the liquidity to pay it off on time, this can serve as a smart float mechanism.

🏡 The Property Purchase Setup

When buying a house, the first financial hurdle is your own contribution - the down payment. Typically, this ranges between 10% to 20% of the property’s base price. In the example above, the base price of the apartment was ₹1 crore (excluding stamp duty, registration, and taxes), and my contribution was 20%, amounting to ₹20 lakhs.

Negotiating the Swipe Fee with the Builder

The first step in this process was to check if the builder would allow payment via credit card, and if so, at what cost. Builders typically pass on the MDR (Merchant Discount Rate) to the buyer, and this varies based on your negotiation skills and the builder’s flexibility.

Some builders only accept a token booking amount by card. Others, with the right conversation, allow the entire down payment via swipe. After a few rounds of negotiation, I was able to get the builder to agree to a 1.5% MDR (inclusive of GST). That meant for the ₹20L payment, I'd pay an additional ₹30,000, bringing the total to ₹20,30,000.

Is this the lowest MDR I’ve seen?

No. I know folks who have made such transactions at or below 1% MDR.

Could I have done better?

Possibly.

But given the value of rewards I’d earn, this was still a net positive, as you’ll see.

Splitting the Payment: Strategy and Execution

With the total payment locked in at ₹20.3L, the next step was deciding how to split it across cards, both for credit limit reasons and reward optimization.

Here’s how I structured the payments:

Now let’s break down the reasoning:

Why Two Different Cardholders?

Axis shares your total credit limit across all cards on a single profile. So unless you have a massive limit, you’re likely to hit a ceiling.

More importantly, Axis has an annual transfer cap on redeeming reward points, and if all your points accumulate in one account, it limits your redemption flexibility.

Having a second cardholder (in this case, a family member) helps distribute both the load and the points.

⚠️ Note: If you’re using someone else’s card (spouse, parent, etc.), always consult your lawyer, CA, or property advisor. Don’t skip this.

Why Two Atlases, and Why This Breakdown?

Let’s talk about the Atlas spends, because they weren’t split randomly:

Atlas (1) – My Own Card

I had already spent on this card earlier in the year.

I was sitting close to the ₹7.5L milestone threshold.

So, I swiped ₹2.5L, just enough to push me over the milestone.

Earned:

5,000 Edge Miles (base reward)

2,500 Edge Miles (milestone bonus)

Total: 7,500 Edge Miles

Atlas (2) – Family Member’s Card (New)

This was a fresh card with no prior spends.

Swiping ₹7.5L here helped me hit multiple milestones in one go.

Earned:

5,000 Edge Miles (New Card Bonus)

2,500 + 2,500 Milestone Bonuses (₹3L and ₹7.5L marks)

15,000 Edge Miles (on spend)

Total: 25,000 Edge Miles

Using both cards allowed me to maximise milestone rewards without overshooting on one card and under-utilising another. This was a deliberate strategy, not just based on credit limits, but on milestone math.

Magnus Burgundy - The Points Workhorse

The Magnus Burgundy cards were a no-brainer for these transactions. At the time:

You earn 12 ER per ₹200 on spends up to ₹1.5L/month

Then 35 ER per ₹200 on spends above ₹1.5L/month

Recently, Axis introduced a cap: rewards apply only up to your credit limit + ₹1.5L. Be sure to stay within this to avoid disappointment

For each ₹5L swipe on the Magnus cards, I earned:

Important Operational Tips

Check MCC Code Before Large Swipes

This is non-negotiable.

If the builder’s POS machine uses an excluded MCC, you won’t earn a single point.

Do a small test transaction, wait for the base points to credit, and only then proceed.

Avoid Overlimit Charges

Never swipe beyond your limit expecting an “overlimit buffer.” Axis may charge steep fees.

Instead:

Swipe up to your limit

Make a payment to the card.

Swipe again once the limit resets

Better yet: split across multiple cards and holders.

Prepare for Security Blocks

Large transactions on an otherwise low-activity card can trigger fraud flags.

Expect:

Calls from the bank

Temporary card blocks

Spread swipes across multiple days or batches if needed.

Down Payment Rewards Snapshot

That’s ₹20.3L of spend turned into multiple free flights, all because of structured card usage.

📜 Registration, Stamp Duty & Legal Costs

Beyond the down payment, a property transaction involves statutory payments that can’t be avoided. These are often bundled into your cost sheet by the builder, who usually pays them on your behalf. But if you’re trying to maximise rewards, there’s a smarter way: pay them yourself or through your credit card.

For my transaction, there were three such components:

Rather than hand this amount to the builder, I requested that they file the documents but use my card for payment, which worked seamlessly.

And yes, if you notice, there was no GST in my transaction as this was a completed, ready-to-move property.

TDS (1% of Property Value) – ₹1,00,000

This is a tax you’re legally required to deduct and deposit on behalf of the builder.

For this, the HDFC Biz Black was the obvious choice due to its 5X rewards on tax payments.

📌 Key Points:

5X is capped at 7,500 RPs per statement cycle

This cap kicks in at ₹56,250 of spend

Remaining spend earns base rate of 3.33%

So here’s how the math plays out:

💡 Note: Biz Black points are only transferable to Singapore Airlines KrisFlyer (1:1 ratio). So unless you value KrisFlyer, these points are best used for SmartBuy flight redemptions.

⚠️ Note: While Biz Black has milestone bonuses (₹5L, ₹10L, etc.), I’ve been using this card regularly and had already hit some of those. For simplicity, I’m excluding those bonuses from this tally.

Stamp Duty + Registration – ₹7,30,000

This is where things get interesting.

In Maharashtra, stamp duty and registration payments are made through the GRAS (Government Receipt Accounting System) portal. These payments are directly remitted to the government and usually coded under “Government Services”, which are excluded on most cards, but not on Biz Black.

✔️ Good to Know:

You can split the payment across multiple challans, useful for managing card limits or reward caps.

Some state portals may not accept Diners or Amex, or even if they do as in my case, Diners didn’t work initially the day I first tried, but did the next day. So yes, it’s trial and error.

📈 Rewards Earned:

Entire ₹7.3L transaction earned at the base rate (3.33%)

Total: 24,333 RPs

Again, the same transfer limitation applies here, KrisFlyer is your only option if you want to convert, else SmartBuy is your best bet.

Total Rewards from Govt Payments

That’s 33,000+ points for payments that most people don’t even consider putting on a credit card.

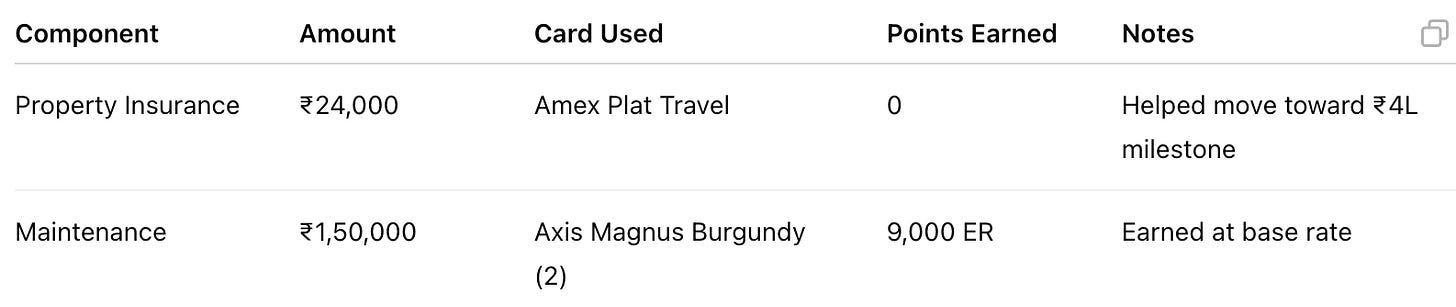

🚧 Property Insurance and Maintenance Charges

Beyond the down payment and statutory payments, there are a few more essential costs that creep into a property purchase, ones that don’t get as much attention, but can still be optimised for rewards if done right.

Property Insurance (₹24,000)

As part of the home loan process with SBI, I was required to purchase a property insurance policy. Depending on the value and location of your property, this can range anywhere from ₹15,000 to ₹50,000 or more.

In my case, the premium was ₹24,000, and while this isn’t a huge spend in the grand scheme of a home purchase, I saw it as an opportunity to target a milestone.

Card Used: American Express Platinum Travel

I find this card difficult to use for organic, high-volume spends.

However, it has an annual ₹4L spend milestone, which unlocks Taj vouchers worth ₹10,000 and 40,000 MR Points.

Insurance spends don’t earn Membership Rewards (MR) points on Amex, but that wasn’t the goal here.

The aim was to move closer to that milestone unlock.

Maintenance Charges (~₹1.5L)

Most new properties come with a prepaid maintenance charge, typically covering 12 to 36 months. If the residential society is already registered, you’ll pay this to the society directly. But more commonly, especially in under-construction or new projects, this amount is paid to the builder.

In my case, I was billed around ₹1.5 lakhs for maintenance, which was included in the builder’s cost sheet.

Card Used: Magnus Burgundy (2)

This was swiped on the builder’s POS, just like the down payment.

By the time I made this payment, it was a new calendar month, so the card had not yet crossed the 1.5L monthly threshold to qualify for 35 ER/₹200.

Hence, the entire transaction earned at the base reward rate of 12 ER per ₹200.

Summary of This Section

🛋️ Interiors and Home Furnishing

Once the legalities and handover were done, the real work began - transforming a house into a home. There are two broad approaches to getting your interiors done:

You work with a freelance designer or an interior design agency, who then subcontracts vendors for execution, and your payments are either made to the vendors directly or to the designer, depending on your work contract. It is less common for this setup to accept payments via credit cards, and it is a lot more fragmented experience.

The second option is these new-age design and execution firms like Livspace, HomeLane and others that offer a one-stop solution to the whole experience. You pay a single invoice to one of these companies and they handle the rest, design, materials, execution, etc, and they accept credit cards amongst other payment methods.

I explored both options but eventually went with HomeLane. Livspace had some red flags based on online reviews and personal references, whereas HomeLane seemed to be a better fit for my needs and expectations. Do keep in mind that you do pay a certain premium with these firms compared to what you would pay if you had to do a lot of these individually. It’s a matter of convenience and how you want to spend your time, money and energy.

The Project: Scope & Payment Structure

My total quote from HomeLane came to ₹22,00,000, excluding white goods (appliances) and other non-scope work.

However, this figure did include electricals, civil changes, plumbing modifications, and other services that are usually not payable via card when done independently.

HomeLane breaks down the payment into milestones, allowing you to plan your spends, and, more importantly, hit monthly credit card reward milestones.

Here's how it was structured:

How I Paid – and What I Earned

Milestone 1: ₹2,20,000

Card Used: Amex Platinum Travel

This transaction helped me hit the ₹4L annual milestone, unlocking:

40,000 MR points (milestone bonuses)

₹10,000 worth Taj Vouchers

4,400 Base MR points

✅ Total: 44,400 MR + ₹10K Taj

I guess it is a slight misrepresentation here to include the entire milestone bonuses as a part of this transaction since some spends on this cards were from earlier, but I am not sure how to put this across for simplicity so we will leave it as it is.

Milestone 2: ₹2,20,000

Card Used: Axis Magnus Burgundy (2)

The card had already crossed ₹1.5L in the same calendar month (due to maintenance charges earlier), so this spend was eligible for accelerated rewards:

35 ER per ₹200 = 38,500 ERs

Milestone 3: ₹6,60,000

Card Split:

₹5,00,000 → Axis Magnus Burgundy (1)

₹1,60,000 → HDFC Diners Club Black (DCB)

This was a strategic move:

I was just short of the ₹4L quarterly milestone on the DCB, which gives 10,000 bonus RPs.

Milestone 4: ₹11,00,000 (Pending)

This tranche is pending, but to avoid hitting Axis’s new reward cap (Credit Limit + ₹1.5L), I plan to split the final milestone evenly across both Magnus cards.

⚠️ Note: Much of the accelerated bonuses are pending due to Axis's credit cycle of 3 months for these bonuses but nevertheless.

Total Rewards from HomeLane Spend

A Note on Other Expenses

Of course, no home is complete without appliances, furniture, décor, and electronics. These purchases are often done over time and spread across various online and offline stores.

While I won't get into the specifics here, this can be optimised too with vouchers and milestones, something most readers of this blog are already familiar with.

♠️ The Trump Card: Paying the Bills (and Earning Even More)

So far, we’ve discussed how I used credit cards to rack up points and miles across the transactions worth ₹52,04,000, covering everything from the down payment and stamp duty to interiors and maintenance.

But there’s a critical detail we haven’t covered yet: how do you pay off these credit card bills?

This is where my Trump Card comes into play, quite literally.

The Card That No Longer Exists (unfortunately) - But few Still Have It

Back in the day, I held a Citi Gold Debit Card, which offered a flat 2% cashback on most transactions. After the Axis–Citi merger, this card was converted into an Axis Burgundy Debit Card - but with a twist.

The normal Burgundy Debit Card earns 2 ERs per ₹200 spent domestically and has a bunch of excluded categories, such as credit card bill payments. However, this ex-Citi variant is grandfathered, and it earns 10 ERs per ₹100 on all spends, including credit card bill payments made via Axis platforms. It is a no-exclusion debit card.

Yes, you read that right:

I earned reward points just for paying off my credit card bills.

And these aren’t junk points, they’re full-fledged Axis ERs, which means:

They pool into the same Edge Rewards ecosystem as your Magnus.

If you hold an Axis Magnus Burgundy, they’re transferable to airline partners at a 5:4 ratio

The Math

Let’s do the math. Across all transactions, down payment, registration, insurance, interiors, I spent a cumulative total of ₹52,04,000.

By paying this amount using my ex-Citi Gold / Axis Burgundy Debit Card, I earn:

That’s over 4.1 lakh transferable miles, just from paying my credit card bills.

This Is Why the MDR Didn’t Matter.

When people say, “But you paid 1.5% extra to the builder,” or “Isn’t that too much?”, it’s like missing the forest for the trees.

Yes, I paid ₹30,000 extra in swipe charges on the down payment and some more as convenience fees on those TDS and Stamp Duty payments.

But between the reward points from swiping and the points from paying off those bills, I earned hundreds of thousands of transferable points and miles, many of which will fund multiple business class flights, hotel stays, and more.

🎁 So finally - How many points did I earn?

Before getting to that, let me again make it clear that the monetary amount shared here is not completely accurate, but not very different either. Additionally, due to the way banks calculate your rewards, rounding off numbers to the nearest threshold and other factors, the calculation will differ by a tiny margin.

However, the blueprint and the strategy can remain the same and be replicated for the most part.

✅ Axis Edge Rewards (ERs): 9,36,650 ER

✅ Axis Edge Miles (EMs): 32,500 EM

✅ HDFC Reward Points: 48,624 RPs

✅ American Express MR Points: 44,000 MRs

✅ Vouchers: 10K Taj Voucher

👋 Closing Out

Hope you enjoyed reading this. This was a highly requested post ever since I put out that tweet. I wanted to go in-depth, I wanted to cover every step. Hope I was able to do that.

If you have any questions, do leave them in the comments below, or I will also be creating a thread in the Substack Chat to discuss this, feel free to ask there.

Congratulations Jay and thank you for this elaborate and informative post. Coming to the last part of your post on payment through the burgundy debit card, which Axis platform are you referring to? I am unable to do it on the Bill Pay section either through the app or their website.

Congratulations! This one is unbelievably detailed and helpful on so many levels.