HSBC Launches Accelerated Rewards - Reading beyond the noise!

HSBC launched accelerated rewards for their Credit Cards, however most of it is just noise. We go beyond the surface in this post.

HSBC has launched their HSBC Travel, a portal similar to ICICI iShop or Axis TravelEdge, available to select HSBC cardholders. The marketplace offers accelerated reward points on travel bookings such as flights, hotels, and car rentals, but with some important caveats.

ℹ️ This is a free post open for all subscribers to read. If you would like to be a premium member and access other subscriber-only posts and receive flight and hotel deals, use the button below. ⬇️

Eligible cardholders include those holding:

HSBC Prive

HSBC Premier

HSBC TravelOne

HSBC Visa Platinum

HSBC RuPay Platinum

First Things First: How HSBC Accelerated Rewards Actually Work

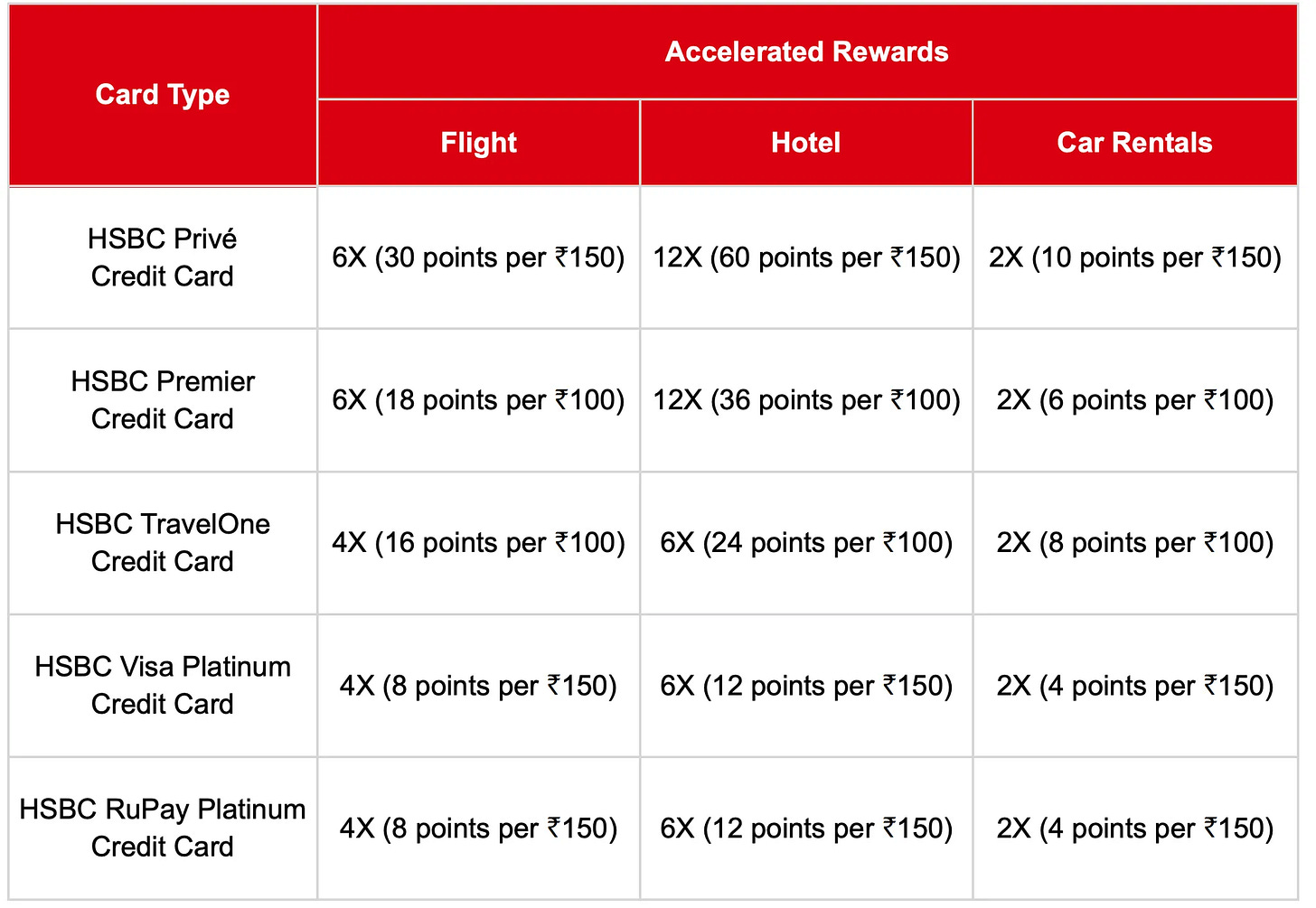

When news about this came out, it was all over on X (Twitter) with some citing ~70% returns on spends or even more, since HSBC is offering 6x on flight bookings, 12x on hotels and 2X on car rentals. Some assumed this means you get 6X on all flight bookings, 12X on hotels, and 2X on car rentals. But that’s not true.

These accelerated multipliers apply only to bookings made via the HSBC Travel with Points Portal, not when booking directly with airlines or hotels.

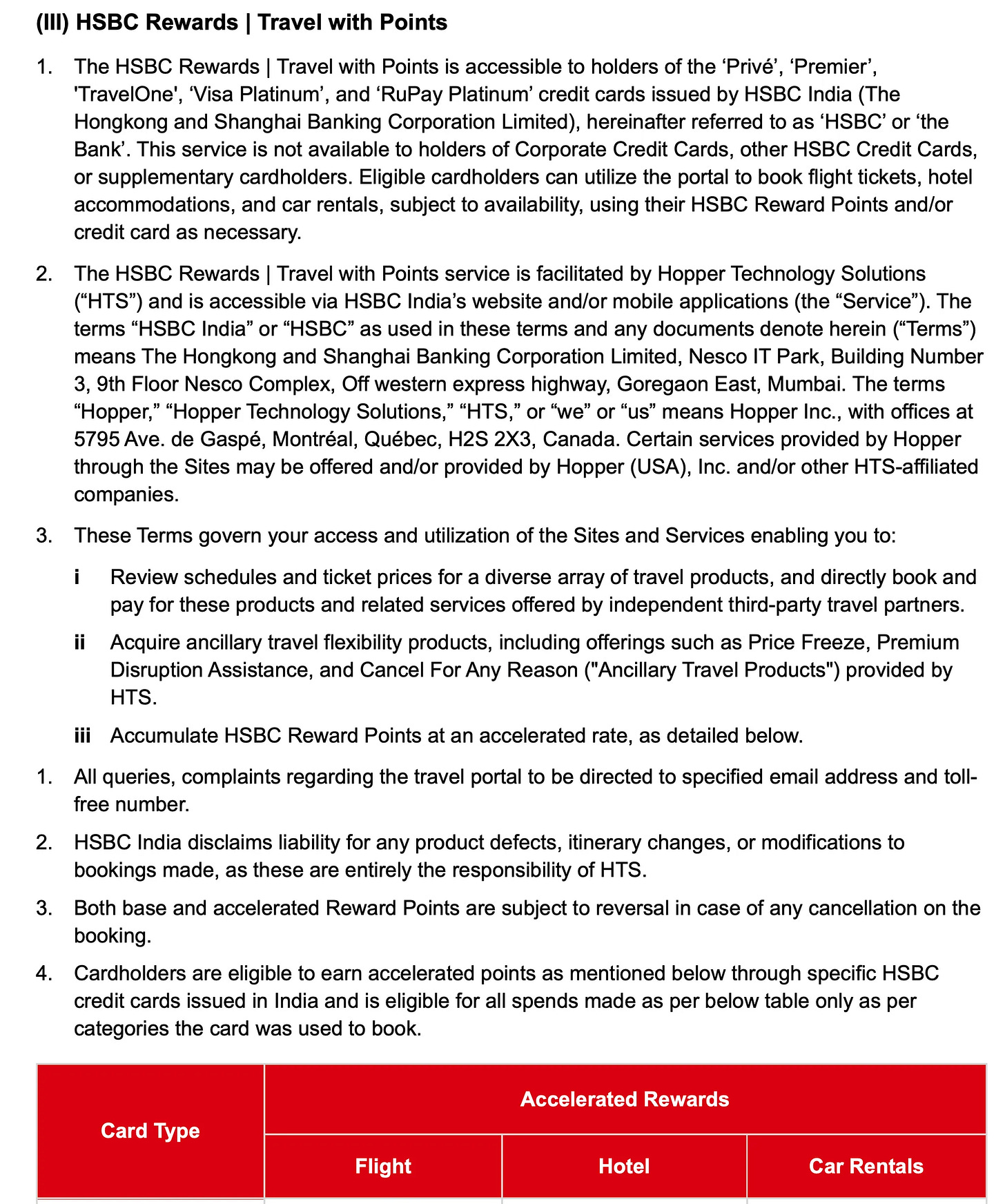

This is confirmed by HSBC’s terms & conditions, which clearly list the accelerated rewards as part of the HSBC Rewards | Travel with Points section.

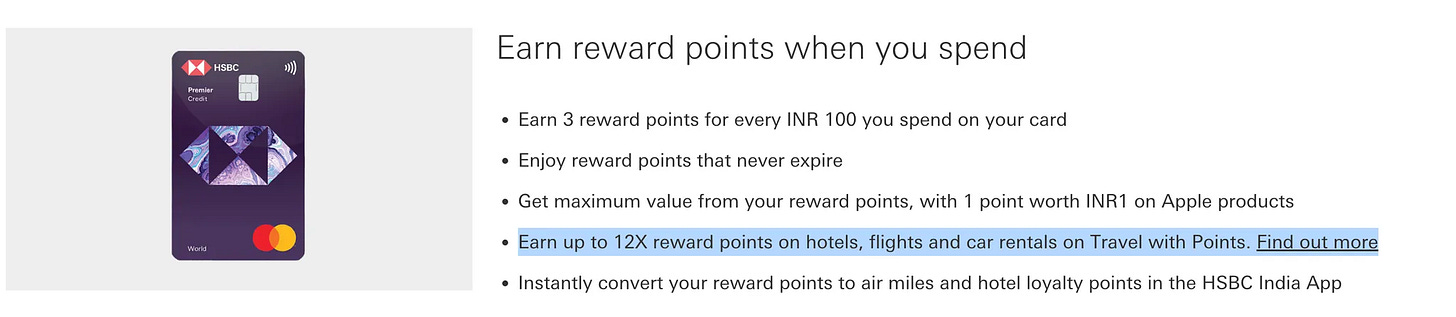

The HSBC Premier Credit Card page further confirms this:

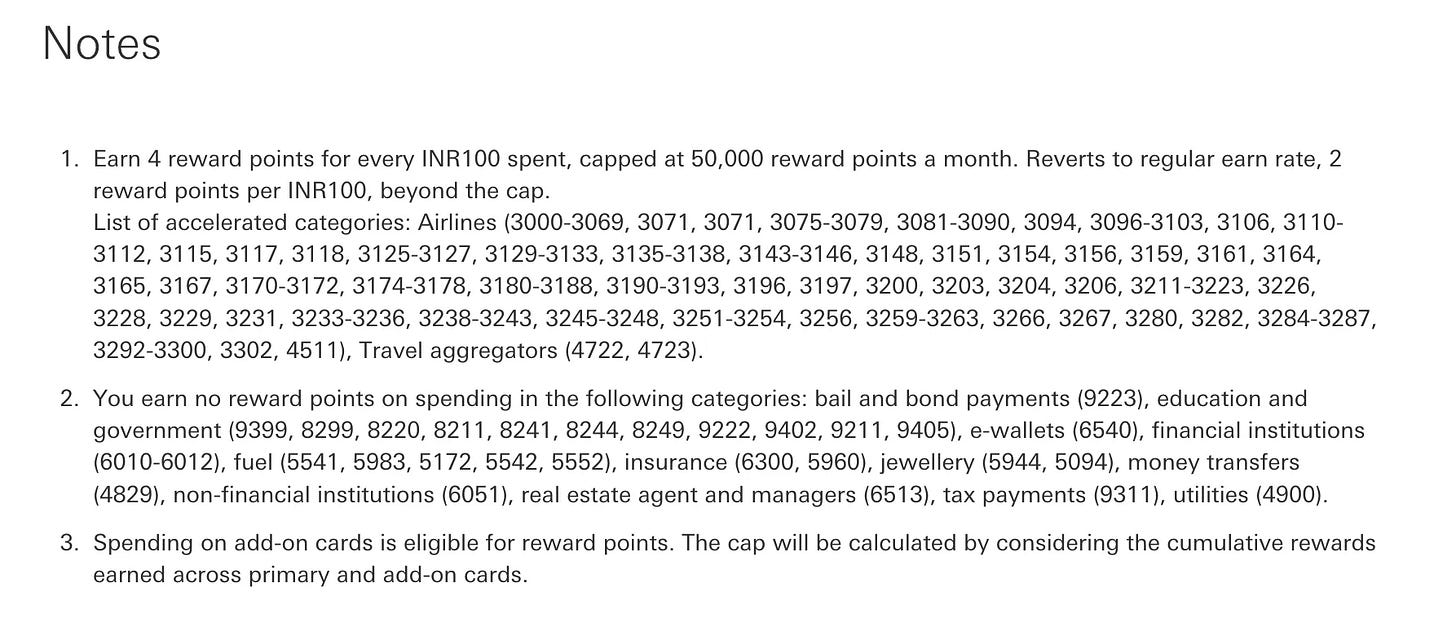

Typically, when you have an accelerated earning category, the T&C specifies the MCCs or a broad MCC Category that earns these accelerated rewards, and we see HSBC doing this for the HSBC TravelOne Card.

👉 Bottom line: Accelerated earnings are restricted to travel bookings made via the HSBC Travel with Points Portal.

How the HSBC Travel with Points Portal Works

For all practical purposes, this works just like Axis TravelEdge or HDFC SmartBuy. It’s an OTA (online travel agency, like GoIbibo or MakeMyTrip) built by HSBC in partnership with Hopper.

🥊 Flight Price Comparison

I ran a comparison across 5 domestic routes and 5 international routes for flights, plus hotel bookings, to see how HSBC Travel stacked up against competitors.

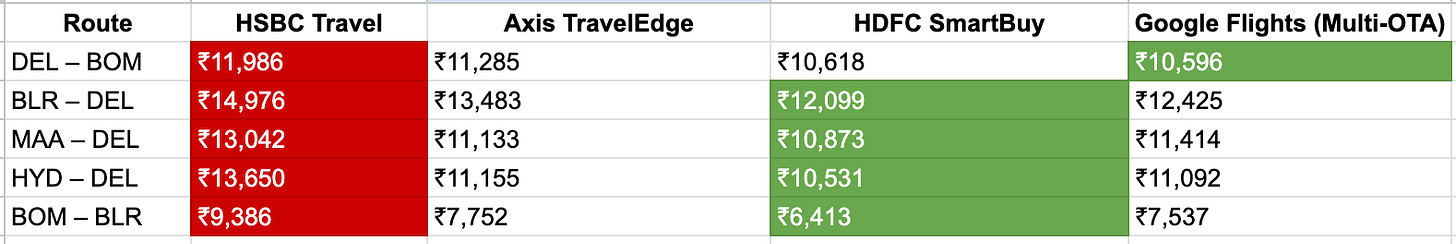

Domestic Routes

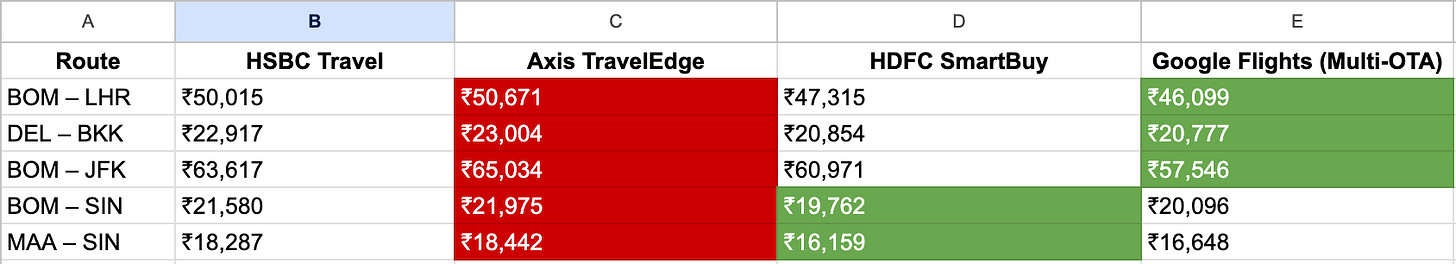

International Routes

🔍 Observations

While these results by no means are definitive or absolute, they however do show a trend. Also note, HSBC Travel charges a convenience fee of ₹300 on domestic flights per customer per leg (one-way trip) and ₹700 on international flights per customer per leg (one-way trip). Similar fees are charged by some of the other portals, such as HDFC and some OTAs. Axis TravelEdge typically does not have a convenience fee.

Interestingly, Akasa flights do not show up on HSBC Travel, even though Hopper does list them.

Features of the HSBC Travel with Points Portal

The HSBC Travel portal offers some “value-add” services:

Price Drop Protection

If the portal recommends that a fare is a “Great Price” and you go ahead and book it, HSBC automatically applies Price Drop Protection.

For the next 10 calendar days, Hopper monitors the same itinerary (same airline, fare class, seat type, etc.) across its inventory.

If the price drops, you receive a Travel Credit up to SGD $50 per booking.

The catch:

The price drop must be at least SGD $5.

The booking has to be non-refundable.

The benefit applies only if you booked after a system recommendation, not if you chose a flight marked as “prices may drop later.”

This is a nice feature in theory, but in practice, the cap of SGD $50 (~₹3,000) isn’t very significant.

Best Price Guarantee

This feature is a 24-hour price match promise.

If you find the exact same itinerary (same dates, airlines, class, cancellation policy, etc.) at a cheaper price elsewhere, HSBC will match it.

To qualify, the competing fare has to:

Be available publicly (not behind a login or special membership).

Be priced in SGD, inclusive of taxes and fees.

Be bookable at the time of claim.

You must submit the claim within 24 hours of your HSBC Travel booking,

and their support team verifies it before issuing the adjustment.

Free Cancellation

For select hotels and flights, the HSBC portal offers free cancellation within a defined time window.

The cancellation terms vary based on the airline or hotel policy.

In some cases, Hopper offers a “Cancel for Any Reason” add-on at an extra charge.

Pay with Points

You can redeem HSBC Reward Points at ₹1 per point.

But this is restricted to HSBC Prive and Premier cardholders.

Hotel Bookings: Why They Don’t Make Sense

For anyone who plays the hotel loyalty game, even casually, booking hotels through OTAs or bank portals is almost always a losing strategy. Here’s why:

No Elite Benefits: Bookings made via the HSBC Travel with Points portal are treated as third-party OTA bookings. That means no complimentary upgrades, no free breakfast, and no late checkout, even if you’re an elite with Accor, Hilton, Marriott, Hyatt, or IHG.

No Elite Night Credits: Nights booked here do not count toward maintaining or achieving elite status.

No Points Earnings or Redemptions: You won’t earn hotel points, nor can you redeem them for free nights if you book through HSBC’s portal.

So, despite the tempting 12X accelerated rewards on hotels, these drawbacks immediately negate the value for anyone chasing elite status or maximising their hotel loyalty program.

Accelerated Earnings

Coming to the accelerated earnings part, which is as follows:

HSBC has capped accelerated earnings at 18,000 points per calendar month per cardholder.

That translates into:

HSBC Premier

Flights: up to ₹1,00,000 per month

Hotels: up to ₹50,000 per month

HSBC TravelOne

Flights: up to ₹1,12,500 per month

Hotels: up to ₹75,000 per month

The above numbers might vary a little bit depending on how HSBC calculates the accelerated earnings portions. As to whether it counts the entire 6X (18 Points per 100 as the accelerated earnings or the Base Earnings + 5X. Base earnings remain uncapped.

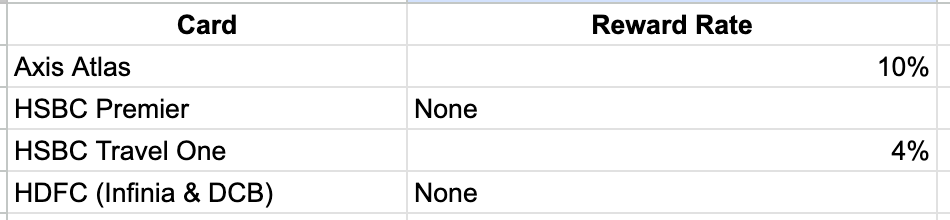

How Does HSBC Travel Compare?

Let’s look at how HSBC’s accelerated travel rewards stack up against Axis Atlas, Axis TravelEdge, and HDFC SmartBuy.

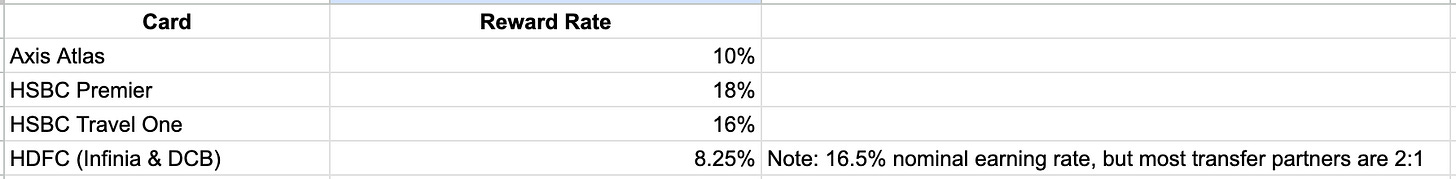

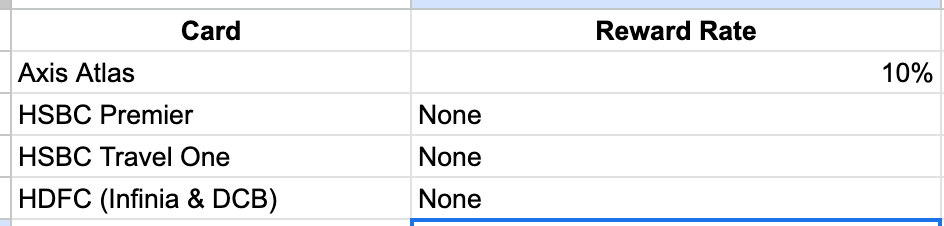

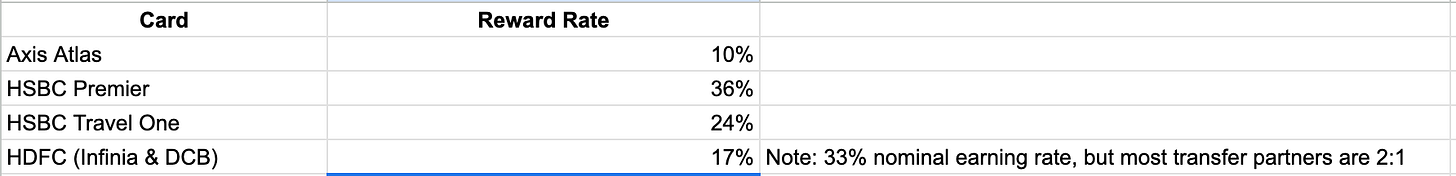

Direct Flight Bookings

Flight Bookings via Bank Portals

Direct Hotel Bookings

Hotel Bookings via Bank Portals

💭 Final Thoughts

When HSBC first launched this portal and the buzz hit Twitter, many rushed to call the HSBC TravelOne an “Atlas Killer”. On paper, the headline numbers (6X on flights, 12X on hotels, 2X on car rentals) certainly looked compelling.

But as the detailed comparison shows, the reality is more underwhelming. Axis Atlas still reigns supreme in most scenarios. Its direct flight and hotel reward rates, coupled with the reliability of direct airline/hotel benefits, make it the stronger travel card.

The one valid argument in HSBC’s favour is that, unlike Axis, it does not have a transfer cap. That said, to unlock the much-publicized 36% (or “72%”) reward rate on the HSBC Premier, you’d have to funnel significant spend through the HSBC Travel portal. And that comes at a steep cost: you’d be sacrificing your hotel loyalty earnings, elite nights, and elite benefits. For anyone who values loyalty ecosystems, that trade-off rarely makes sense.

From my perspective, this isn’t particularly exciting. For direct bookings, Axis Atlas still remains the go-to card. For hotel stays, especially at chain properties, I’d always book direct to retain status benefits.

If there’s one narrow use case where HSBC Travel might make sense, it’s revenue flight bookings through their portal, especially when paired with features like Price Drop Protection or Best Price Guarantee. But even there, you’d want to double-check fares carefully, because my comparisons showed HSBC Travel often prices higher than Axis TravelEdge, HDFC SmartBuy, and even Google Flights.

However, what could truly make this product exciting is if HSBC introduces a reward multiplier on a gift voucher portal, similar to HDFC Gyftr. For many users, everyday spends like groceries, fuel, dining, and shopping can easily be routed through such a platform.

So, while the HSBC Travel with Points portal adds another option in the market, it’s far from a game-changer today. For now, it feels more like a nice-to-have side benefit rather than a disruptor. But the groundwork is there, and if HSBC leans into multipliers beyond just travel, this could become a powerful earn-and-burn ecosystems in India.

Gm Jay,You are a true ‘ Card & Miles gemologist ‘ your lens gives us a true picture

Précised