HDFC Bank has revived one of its most lucrative promotions from the past, and the window is closing fast.

The Opportunity (Valid Only Until March 31st!)

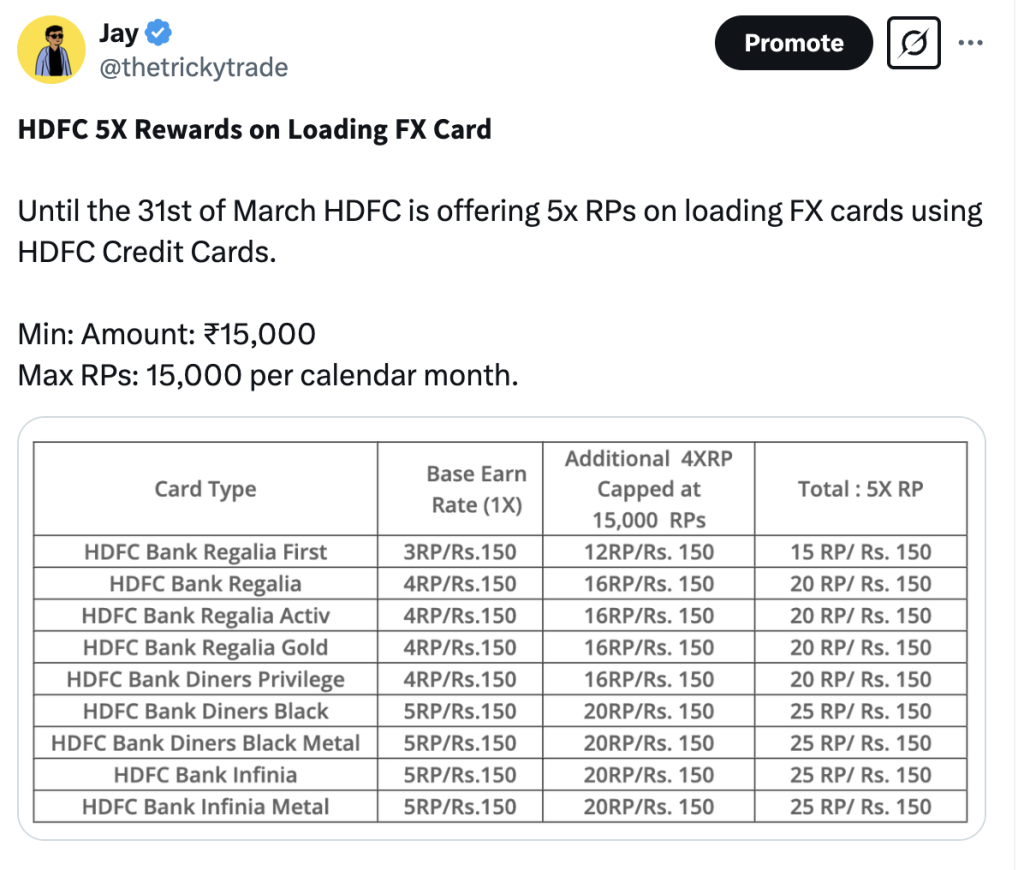

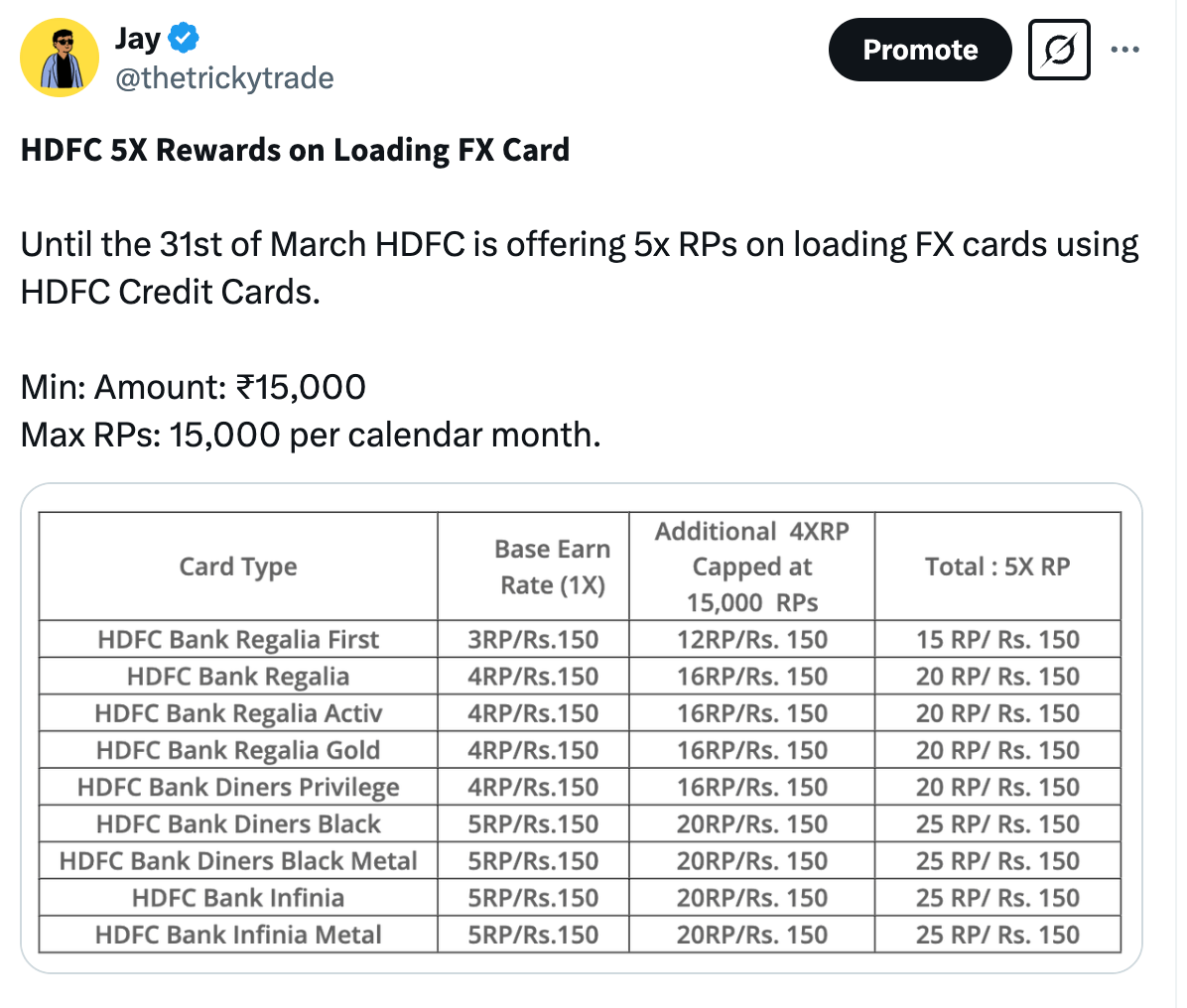

As of last month, HDFC Bank has as very lucrative promotion, that I shared on X, probably the first one to spot and write about it. The offer is pretty self-explanatory, you get a 5X on loading your HDFC Bank Forex Cards using your HDFC Credit Cards.

The Interesting Bit: You can always transfer the unnused balances in your Forex Cards can be redeemed/transferred back to your bank account, as is the case with all Forex Cards issued in India.

Update 19th March: This offer has now been extended to the Business Biz Power and Biz Black Credit Cards too with the same 15K capping.

Breaking Down the Mechanics

Step 1: Get Your Cards Ready

You’ll need two key HDFC products:

Primary Tool: An eligible HDFC credit card (Infinia or Diners Black offer the highest returns)

Secondary Tool: An HDFC Regalia ForexPlus Card (crucial for its zero cross-currency markup structure)

Step 2: Load Your Forex Card

Optimal Amount: $1,000 USD (approximately ₹88,000)

Loading Platform: Must use one of these specific links for the 5X points to trigger:

hdfcbankprepaid.hdfcbank.com/hdfcportal/index

getprepaidcard.hdfcbank.com/index.aspx

hdfcbankprepaid.hdfcbank.com/hdfcportal/quickreloadnew

💡 Important: Loading through any other channel won’t earn you the bonus points!

Step 3: Earn Your Multiplied Rewards

The magic happens when you pay for the forex load using your HDFC premium credit card:

Base Earning Rate: Infinia/Diners Black earn 5 points per ₹150 spent

Promotion Bonus: Additional 20 points per ₹150 (4X more)

Total Earning: 25 points per ₹150 (~16.67% return)

Step 4: Transfer Funds back to your Bank Account

In the following weeks or months, simply withdraw the loaded USD

You can transfer it back to your bank account by calling HDFC customer care

Alternatively, use the card for any foreign spending that you might have.

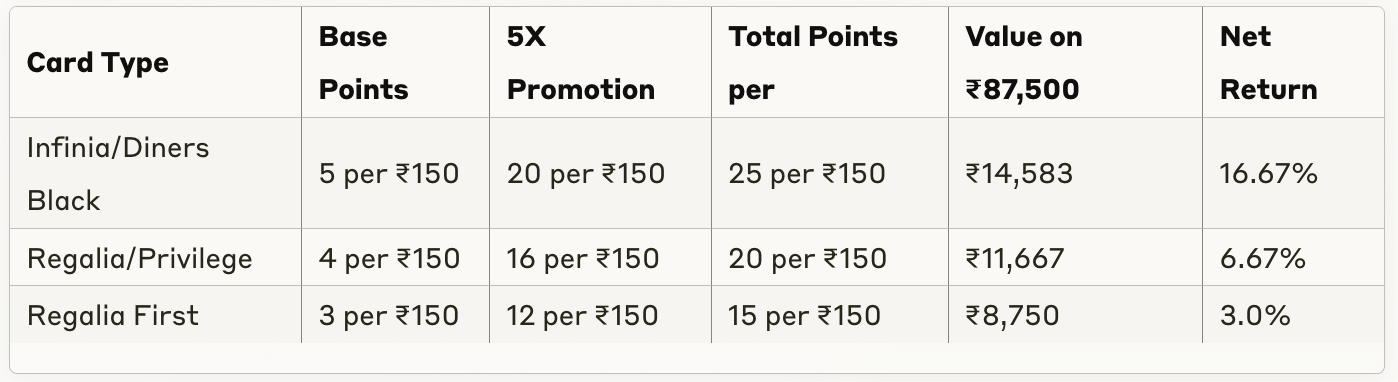

The Numbers Game

Let’s break down the economics for an ₹87,500 load (approximately $1,000 USD):

Costs Involved:

Card Issuance Fee: ₹0 (assuming you load at least $1000 USD into the card)

Loading Charges: ₹89

Forex Markup: Approximately ₹2,200 (considering a 2.5% spread with GST and other charges)

Currency Conversion Tax: ₹45 (0.18% up to ₹1 lakh)

Withdrawal Fee: About ₹2,200 (again considering a 2.5% spread on the transaction)

Total Costs: ≈ ₹4,534

Rewards Earned:

For Infinia/Diners Black: 14,583 points (worth ≈ ₹14,583)

Net Rewards: ₹14,583 – ₹4,534 = ₹10,049

👍 Pointers to Maximize This

Move Fast: The offer ends March 31st, 2025, and ForexPlus cards take a while to get issued and delivered.

Leverage Waived Fees: Load $1,000+ in one go to get the card issuance fee waived completely.

Maximize Monthly Caps: The promotion allows up to 15,000 bonus points per month, achievable with a load of approximately ₹112,500.

Addressing the elephant in the room.

Is this legal? The reason I am writing about this is because I do not see anything that says otherwise. The offer is pretty straightforward, we are not breaching any ToS and moving balances from FX cards back to your bank account has been a feature for decades, and I am someone who is typically pretty conservative when it comes to doing these circuses.